Risk Assessment

Assess borrowers' creditworthiness to manage and reduce lending risks.

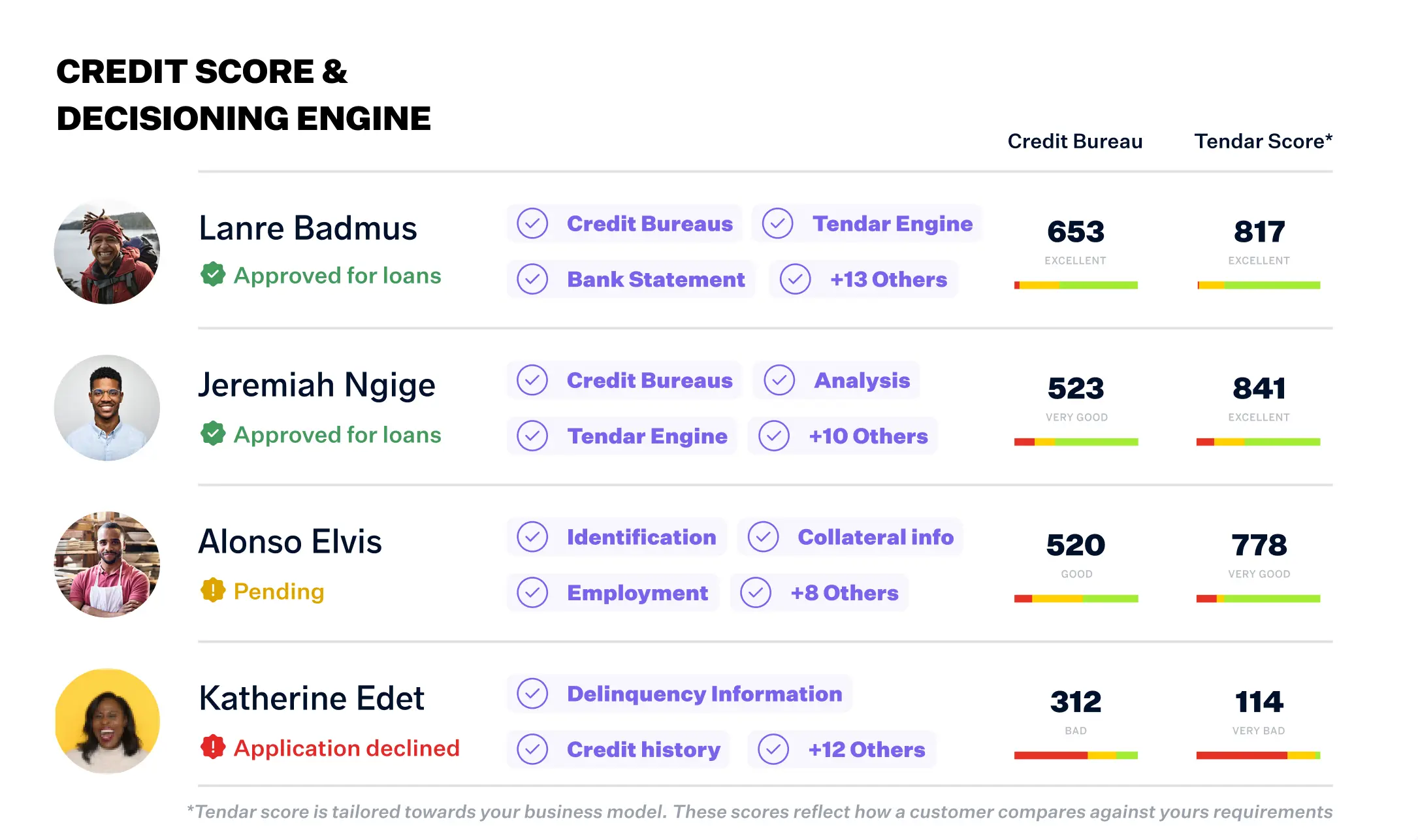

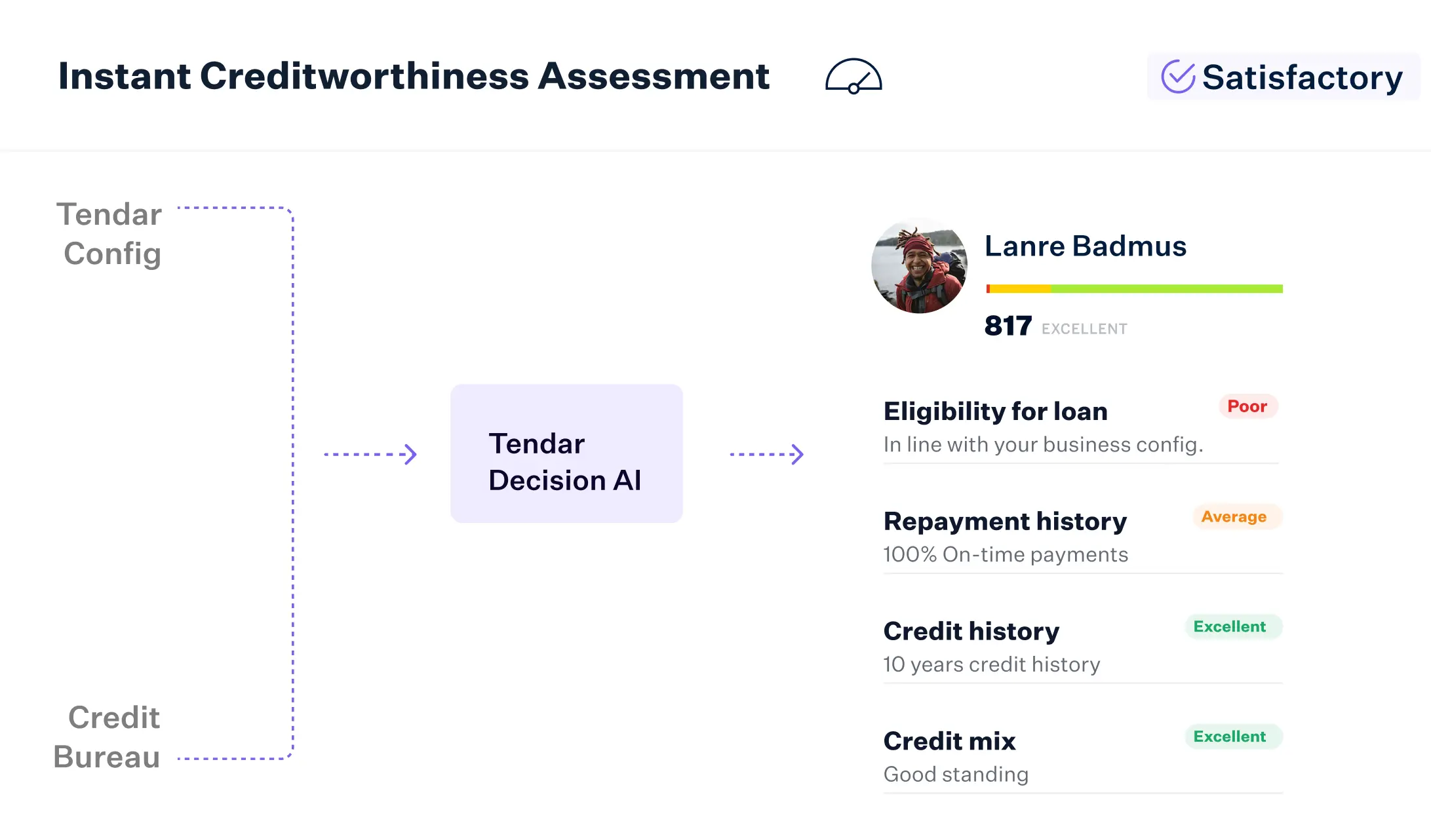

Credit Score & Decisioning Engine

Enhance lending decisions with Tendar’s AI-driven tools for analyzing credit and assessing risks. Our platform delivers accuracy and reliability, helping you navigate every stage of the lending process with confidence.

Contact Sales

Empower informed lending decisions through precise credit checks, ensuring risk mitigation and optimized loan offerings for users.

Assess borrowers' creditworthiness to manage and reduce lending risks.

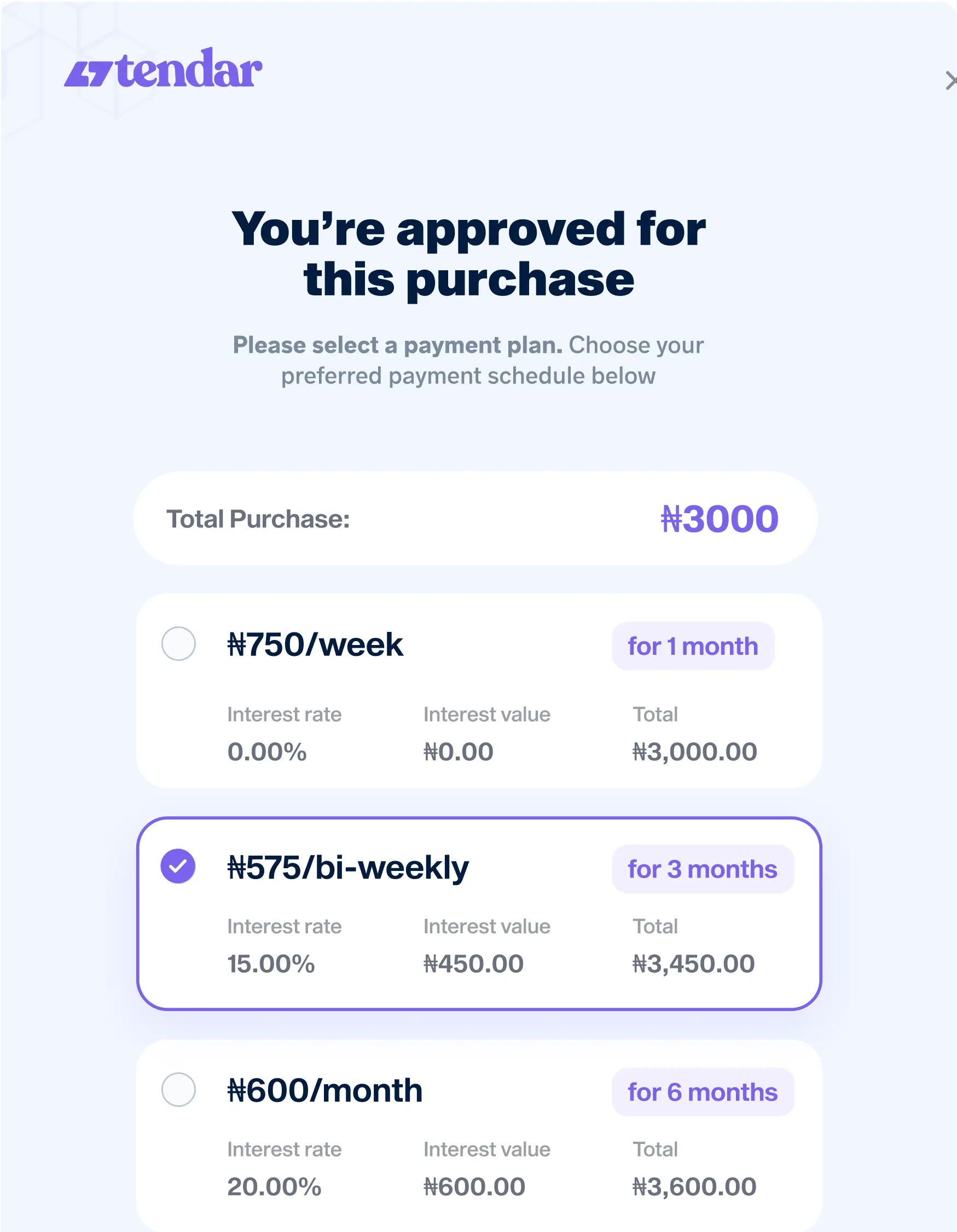

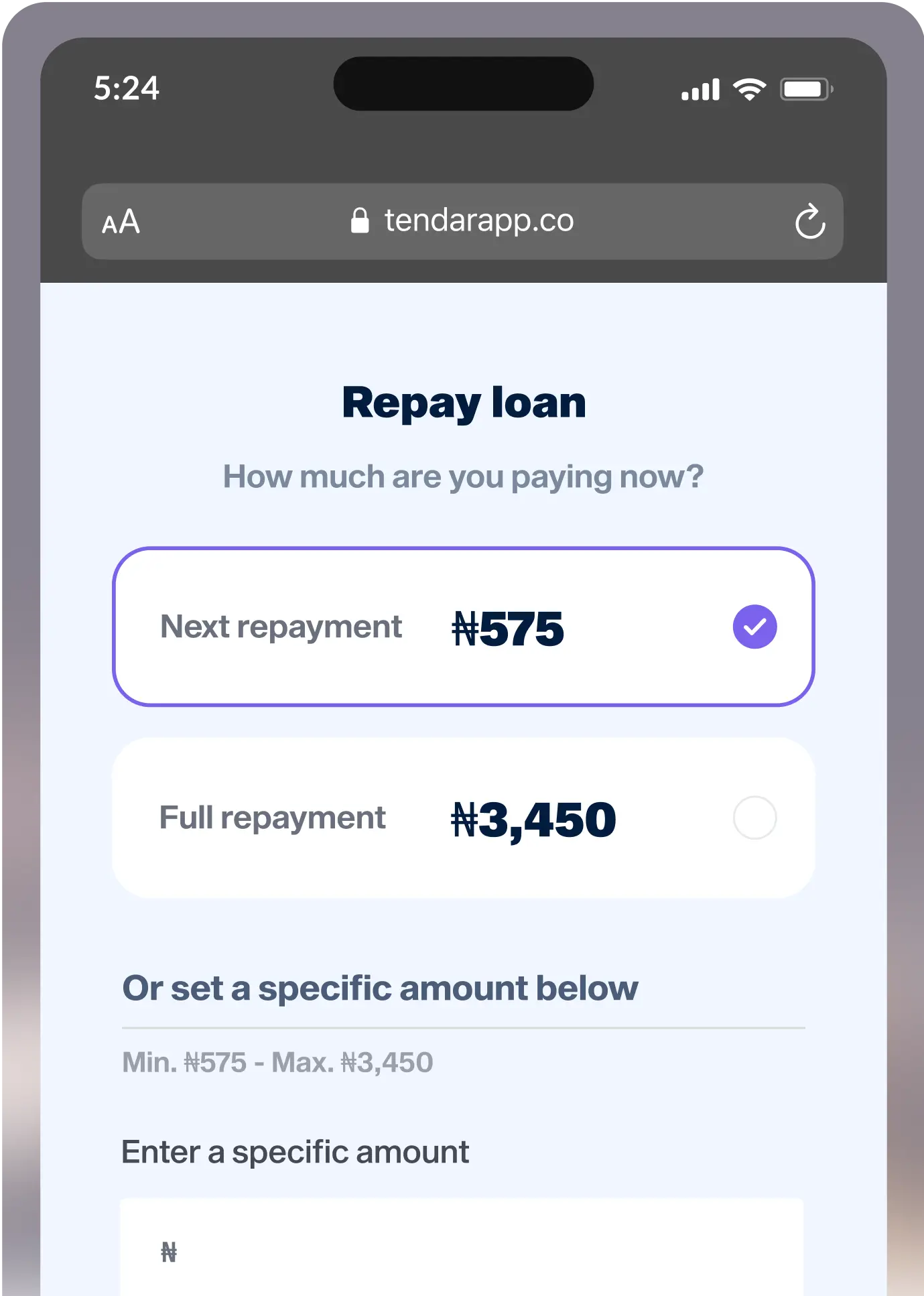

Customize loan products and terms to meet each borrower's unique financial needs and abilities.

Lenders and financial institutions can reduce the risk of defaults, ultimately leading to lower default rates and better overall portfolio outcomes.

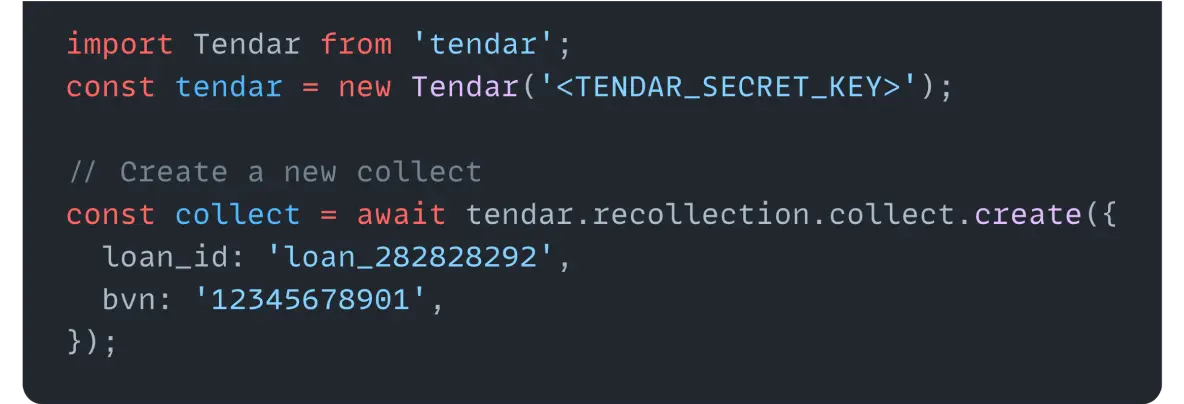

Integrate our next-gen credit engine into your product without any hiccups. Save time, cut costs, and launch solutions your customers will love.

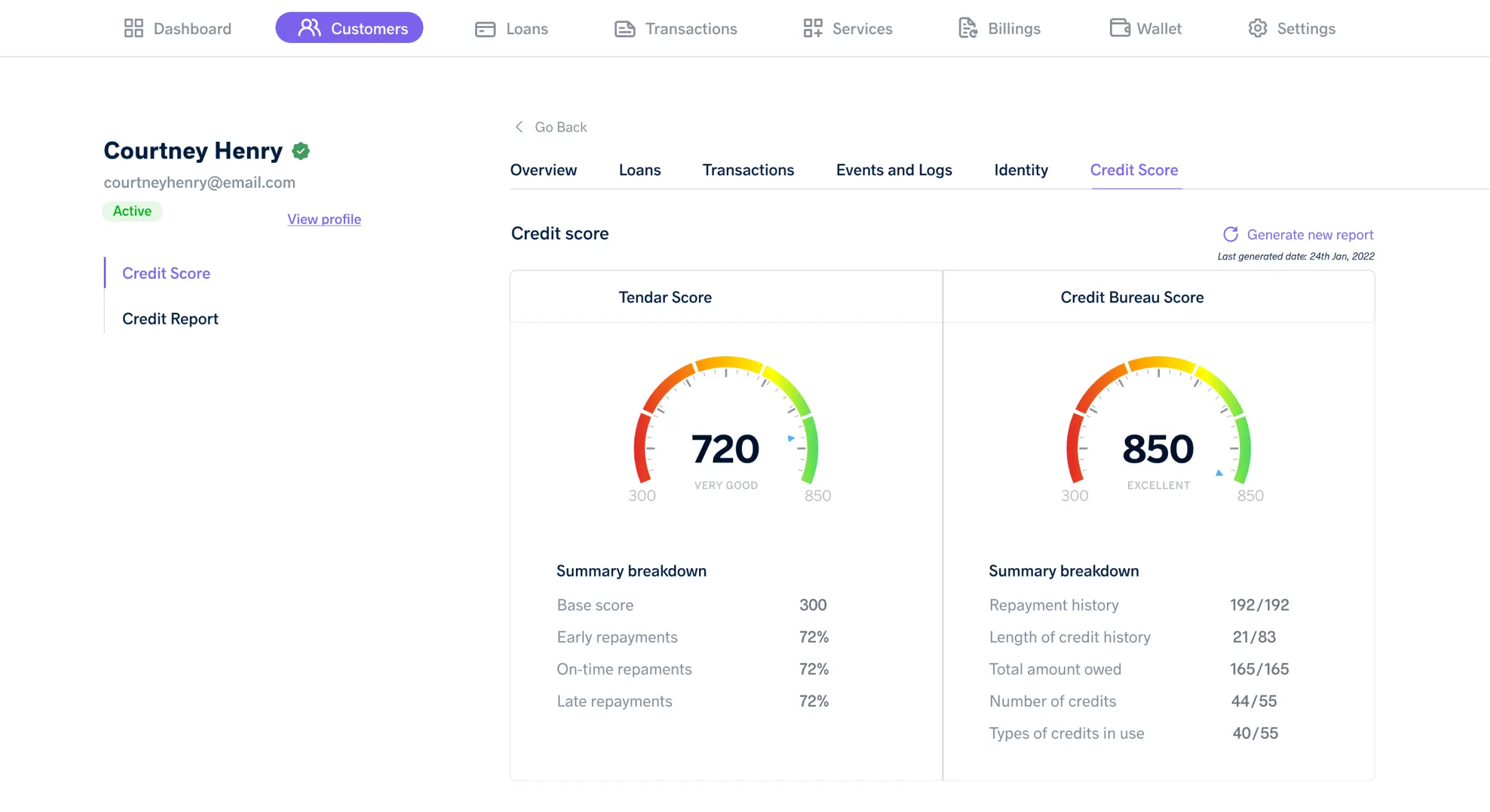

Get StartedEnhance credit evaluation with our AI- driven credit scoring solution, seamlessly integrating credit bureaus for rapid access to critical data. Expand your customer base by combining AI- powered analysis of bureau insights with key metrics such as employment status, income, and cash flow to deliver faster, smarter lending decisions.

Enhance credit evaluation with our seamless credit scoring solution, by integrating credit bureaus for quick access to critical data. Expand your customer base by combining bureau insights with key metrics such as employment status, income, and cash flow.

We pride ourselves on being developer-friendly, offering adaptable lending building blocks tailored for developers.

Quickly assess if users qualify for a loan.

Set specific parameters to match your lending policies.

Get immediate results based on current data

Enhance customer experience with pre-built modules for credit scoring, loan management and so much more. Grow your business without starting from scratch.

Empower your customers with flexible payment options using Tendar’s BNPL Product. Seamlessly integrate our advanced BNPL solution into your site or app, letting customers choose their payment method at checkout. Drive sales, boost loyalty, and simplify your checkout process.

Get Started

Our low-code service lets you launch your digital lending platform in one week with zero development time.

Get StartedWhat our customers are saying