Instant Credit Decision

Our credit scoring engine instantly evaluates each user in real time, providing quick eligibility decisions for Send Now, Pay Later.

SNPL

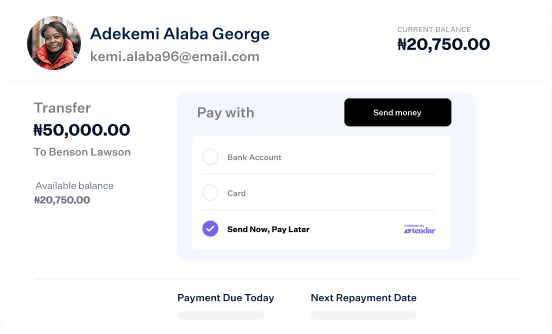

Tendar’s Send Now, Pay Later allows users to transfer funds instantly without full balance, while repayments are managed seamlessly over time.

Contact Sales

Give your users the power to send money anytime, even when funds fall short.With Tendar’s Send Now, Pay Later, you can boost engagement, increase transactions, and scale your business effortlessly.

Our credit scoring engine instantly evaluates each user in real time, providing quick eligibility decisions for Send Now, Pay Later.

Once approved, funds are transferred instantly to the recipient through Tendar’s secure payment APIs.

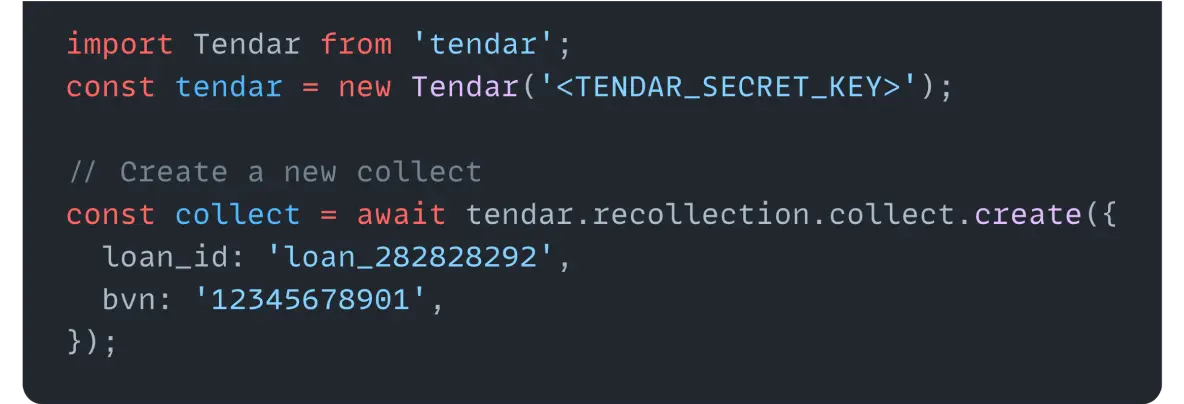

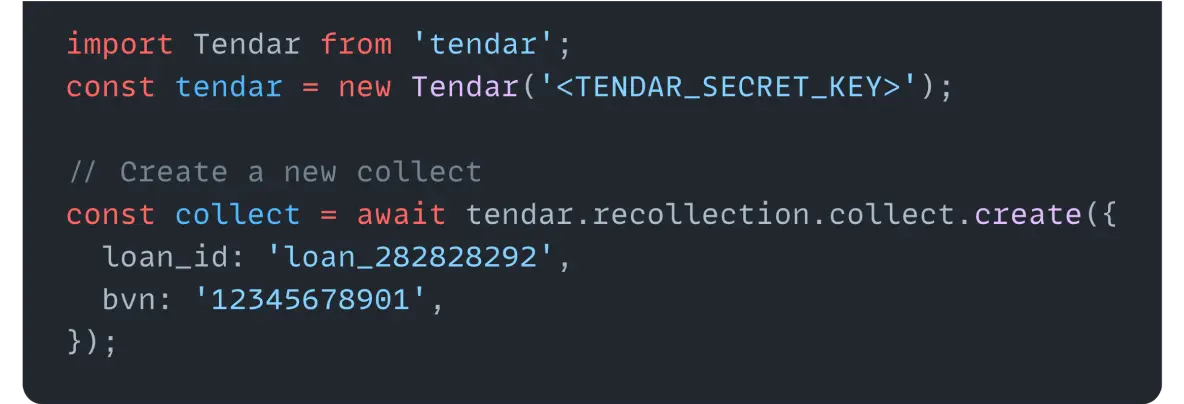

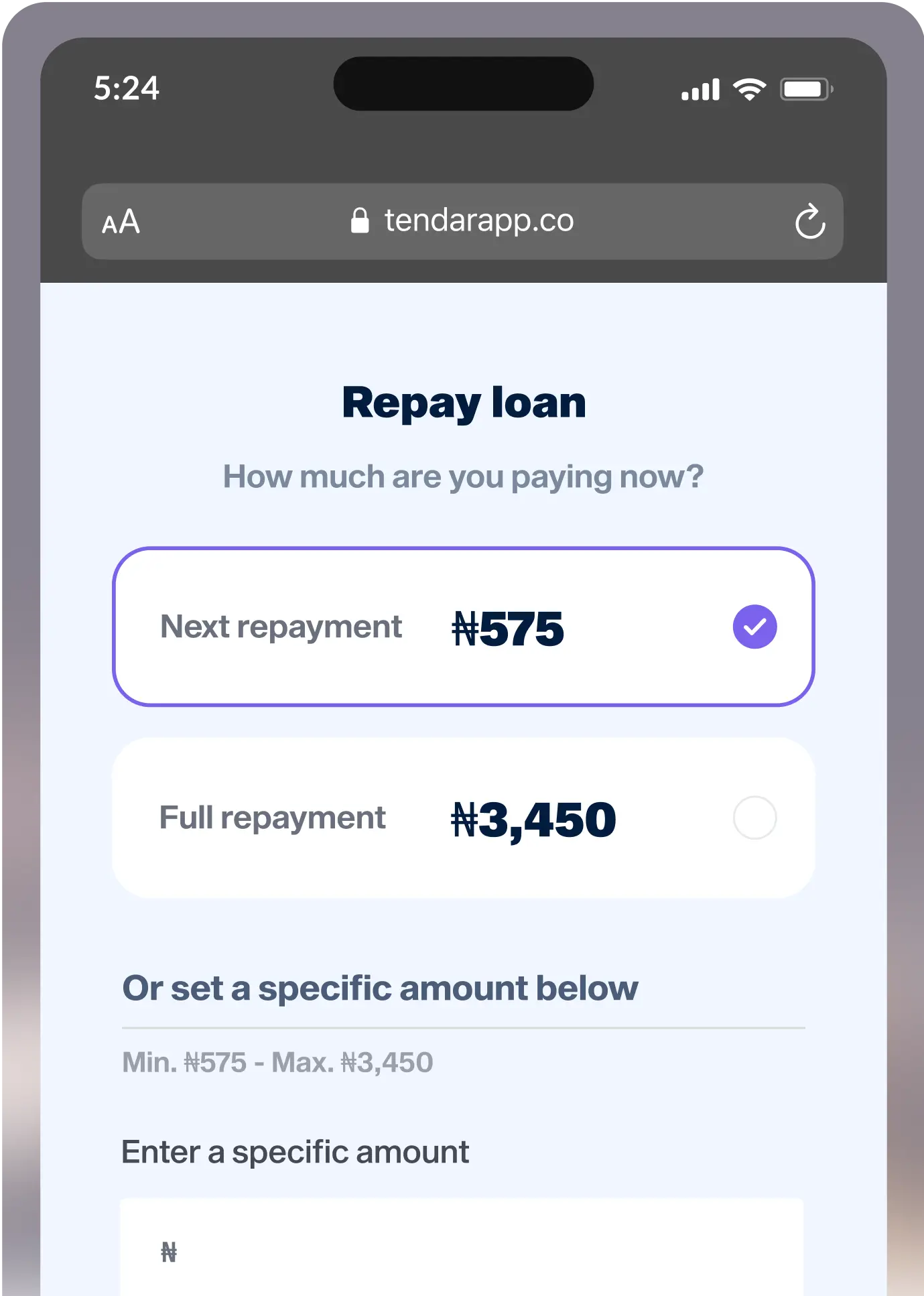

Tendar’s recollection system ensures smooth repayments through direct debit or card recovery, thereby reducing defaults.

Our continuous credit monitoring helps businesses maintain healthy portfolios and control risk exposure.

Ready to give your customers instant flexibility? Book a call with our team or fill out the form to learn how to integrate Send Now, Pay Later into your business.

Get StartedGive your users instant access to funds when it matters most. With Send Now, Pay Later, you’ll drive stronger engagement, higher transaction volumes, and new revenue opportunities.

Enhance customer experience with pre-built modules for credit scoring, loan management and so much more. Grow your business without starting from scratch.

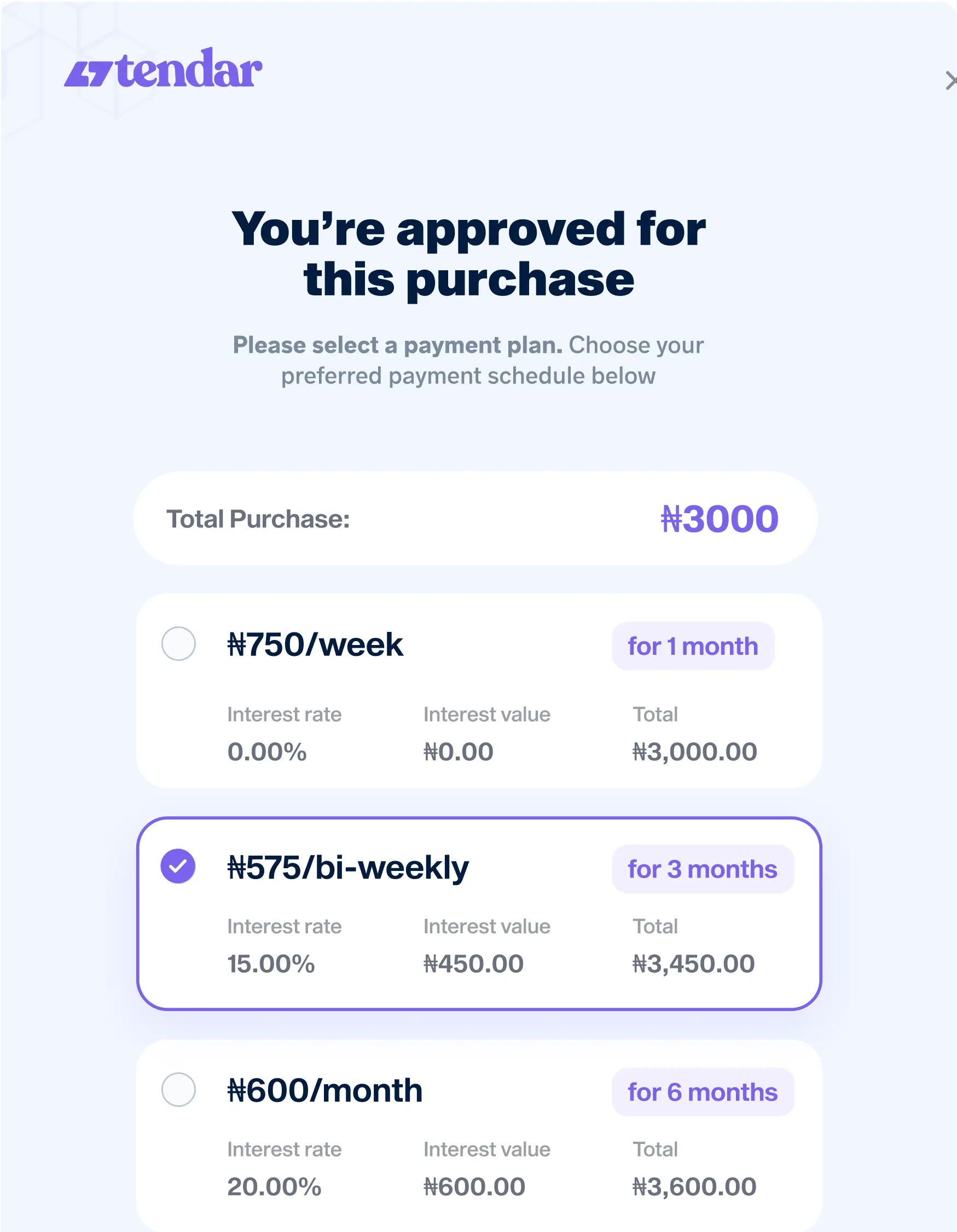

Empower your customers with flexible payment options using Tendar’s BNPL Product. Seamlessly integrate our advanced BNPL solution into your site or app, letting customers choose their payment method at checkout. Drive sales, boost loyalty, and simplify your checkout process.

Get Started

Our low-code service lets you launch your digital lending platform in one week with zero development time.

Get StartedWhat our customers are saying